You have heard about cryptomoney and want to know more? We are going to explain you what it is, the main cryptomonnages, the different exchange platforms, the wallets but also the mining of cryptomonnages.

The concept of cryptography

A cryptomoney is an electronic currency that allows transactions to be carried out through cryptographic validation. These cryptomoney can then be exchanged on exchange platforms, they also make it possible to remunerate the network nodes that validate transactions on the network, thus freeing them from trusted third parties: banks, financial institutions, states, companies. Where there is a trusted third party that enables transactions to be carried out, there is also an opportunity for cryptography and a blockchain network.

In 2008, Bitcoin paved the way for the era of cryptomoney, with a single goal: to optimize international transactions by freeing itself from the current trusted third parties. Today, there are thousands of cryptomoney systems, and while each one has its own particular advantages, we can nevertheless mention a few that make most cryptomoney systems a means of revolutionizing transactions, whether monetary or not:

Disintermediation: The technology and the transparent operation of the Blockchain generate the trust necessary for user agents to carry out exchanges (monetary, property, etc.) without requiring the control of a trusted third party (bank, notary).

Security: The block code and decentralized architecture guarantee the inviolability of information. Security is ensured by 2 mechanisms:

– A cryptographic process: the code of each block is linked to the code of the one before it, the modification of a block would thus lead to the modification of the whole chain;

– A decentralized aspect which implies a replica of all the blocks in each node of the network, this makes it possible not to risk a loss of data.

Autonomy: The creation of a cryptographic system pays for the infrastructure costs. Indeed, the computing power and hosting space are provided by the network nodes.

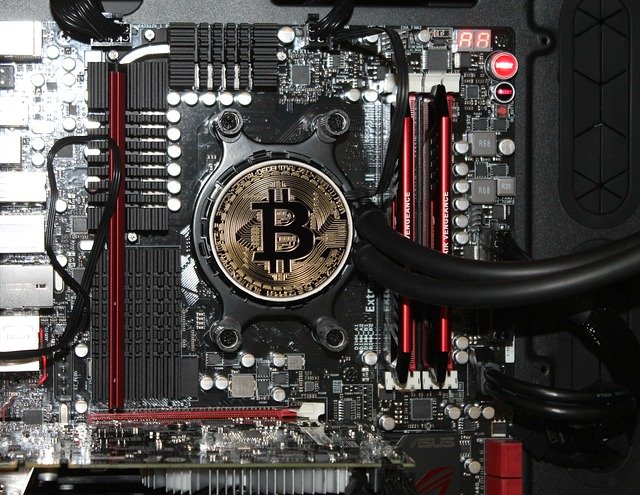

The “miners”, who ensure the operation of transactions on the Blockchain, provide the hardware, computing power and storage space, in exchange for which they receive cryptomoney.

How is crypto-money made ?

People who make crypto money are called minors. It is also said that they undermine a crypto-money. Miners are an integral part of the process. Without them, the Blockchain would be frozen. A miner confirms the transactions that take place on the Blockchain.

For example, imagine that Peter gives Paul 3 Bitcoins. The transaction will be immediately broadcast over the network, peer-to-peer, consisting of computers called nodes. However, it is only after a certain amount of time that the transaction will be confirmed by the computers belonging to the networks using the algorithms specific to the Blockchain. Once confirmed, the transaction now forms a new data block for the registry. It is added to the others in the existing Blockchain, permanently and immutably.

Behind these network computers are minors who validate the transactions. To confirm a transaction, a minor must find the product of a cryptographic function that connects the new block to its predecessor. This is called proof of work. In exchange for their services (and the computing power mobilized for this purpose), they get a reward in the form of tokens.

How do you undermine a crypto-money?

To undermine a crypto-currency, it is most often sufficient to install software on your computer that uses the processor or graphics card, or both, in order to be able to solve the cryptographic problem requiring a relatively large amount of computing power, which will enable you to touch new units of the crypto-currency in question.

Beware however, the main crypto-currencies have become too difficult to undermine for private individuals. Undermining many of them has largely become professionalized and takes place partly in Chinese farms, buildings of several thousand square meters where tens of thousands of servers are running day and night to undermine crypto-currencies (Bitcoin, Litecoin, etc.).

Faced with this competition, cloud mining type solutions have been developed. No investment in specific hardware is required. All you have to do is get in touch with a company that has invested in the necessary hardware and “rent” your computing power. But beware, the scams are numerous!

Which cryptomony to undermine?

Of course, individuals focus on undermining the most profitable virtual currencies such as Bitcoin, but also Dash, Ethereum, Monero, Litecoin, etc..

Nevertheless, it is very difficult today to make money by undermining a crypto-currency. It is often much more interesting to invest in virtual currency in order to hope to make money.

Miner/developer: who makes the crypto-currency?

The role of the cryptomoney miner is thus to validate the transactions carried out. He is thus paid in tokens of the crypto-money for which he has confirmed a new block.

The role of the developer is very different. A crypto-money developer will develop the computer protocol at the base of the crypto-money which defines in particular the number of tokens in circulation, their speed of circulation, their storage power, etc. He is a bit like the architect of the network.

The main cryptomoney systems

Here are the three main cryptomoney companies, they represent the main capitalizations of the cryptomoney market. Investing in these 3 cryptomonnages is a good start to build your portfolio. Afterwards, you can also study promising cryptosystems such as EOS, Litecoin, Binance coin… If you want to become a pro in cryptomoney trading, you will then look for niche cryptomoney trading, with lower capitalization but which can have much higher growth rates. A 3 or 4-digit percentage increase in price is not uncommon in the world of cryptomonries.

Bitcoin (BTC)

Bitcoin is the first cryptomony, it was created and validated following Satoshi Nakamoto’s white paper published in 2008: “Bitcoin, a Peer to Peer Electronic Cash System”. Bitcoin is a decentralized cryptographic system based on blockchain technology to manage transactions and issue digital coins without the need for a central authority. The Bitcoin course is represented by the letters BTC on the exchange platforms.

Ethereum (ETH)

The Ethereum network was designed to offer an open and decentralized blockchain platform that will allow all developers to create applications using the concept of “Smart Contract”. The Ethereum network issues a cryptomony to reward the nodes of the network, this cryptomony is named Ether and is symbolized by the three letters ETH on the exchange platforms.

Ripple (XRP)

Initially introduced in 2012, it is a real-time payment system. It is intended to replace the current international payment system SWIFT, which has been in place since the 1970s. Unlike Bitcoin, Ripple does not want to revolutionize the international monetary system, but rather to provide a platform to facilitate international banking exchanges.

Ripple is a cryptographic currency issued by the company of the same name and appears under the name “XRP” where X stands for a non-domestic currency and RP stands for Ripple.

How to invest in crypto currency ?

There are two ways to obtain encrypted currencies:

– by selling a good or a service and by demanding payment in the cryptocurrency of your choice ;

– by converting “traditional” currencies (euro, dollar, etc.) into encrypted currency.

Kraken, Bitstamp, Poloniex, Coinbase, or Circle, for example, make it possible to convert euros into Bitcoins or even other virtual currencies quite easily.

In order to convert your Euro into Bitcoins, you will need to register on this platform by providing an electronic copy of a coin.

Create a wallet of crypto currency

No matter how you obtain your money, you will need to create a “wallet” to keep your money.

An encrypted currency wallet is an address in the form of a sequence of numbers that can be accessed with a password. You can create a Bitcoin address and password for free and quite simply on a dedicated platform such as BitAddress.org for example. For other crypto-currencies, other specific platforms exist. Cryptanor supports several currencies.

Finally, to pay with a crypto-currency (or to receive a payment in crypto-currency), an intermediary is necessary:

– Either an exchange platform.

– Or a software to download.

Be careful, these intermediaries usually charge commissions. We also strongly recommend that you choose your intermediary carefully.

Beware also of the scams of all kinds that flourish on the web and the brokers who refuse to return the sums held in your account.

See also :